Q&A on Management Strategy for Achieving Long-Term Growth

This Q&A has been prepared to provide our investors with a deeper understanding of the background behind our sustained growth over many years and to outline our medium- to long-term management direction for the future. It presents our perspectives on a wide range of topics—including the significance of our business diversification, the future outlook for each business domain, our approach to global expansion and M&A, and our stance on corporate governance and shareholder engagement.

Through this Q&A, we aim to convey a comprehensive view of our management strategy and reaffirm our continued commitment to enhancing corporate value in a sustainable and long-term manner.

Q1. Reason for the Disclosure of Rohto Pharmaceutical’s Medium- to Long-Term Growth Strategy and Outlook (May 2025)

We have consistently provided timely disclosures and explanations of short-term information, including quarterly financial results. However, with respect to medium- to long-term growth strategy, we have deliberately avoided a goal-driven planning approach that rigidly targets specific outcomes. Instead, we have adopted a strategy of updating our plans annually to enable agile and dynamic decision-making. As our business domains have expanded and our diverse operations have become increasingly interconnected and complex, we recognize that it has become more challenging for stakeholders to gain a comprehensive understanding of the overall structure of our business.

While our Integrated Report (Well-Being Report) has been prepared with the intention of presenting this overall picture as concretely as possible, we decided to disclose our medium- to long-term growth - together with the underlying strategic framework - in order to enhance stakeholders’ understanding of our management direction and long-term vision. This outlook will be reviewed and updated on an annual basis. It should be noted that the figures and projections presented herein do not represent a fixed view of what we will necessarily achieve in five years. Rather, they are based on the premise that we will continue to make flexible and timely management decisions aimed at further enhancing our corporate value.

Q2. Why does Rohto Pursue Diversification Across Multiple Business Domains?

A strategy that focuses corporate resources on selected strong business areas can be effective when markets are stable, growth is predictable, and competitive dynamics remain relatively unchanged. However, in today’s VUCA environment, relying solely on a single business or market causes significant structural vulnerability.

Our founding business, OTC medicine in Japan, has long operated in a gradually contracting market environment. Although we have benefited from the exceptional growth of the eye drops market within this sector, driven by increasing demand over the years, future stagnation will be inevitable due to Japan’s declining population. As a result, even our core business faces limitations in terms of major expansion.

For many years, we have been committed to fostering a corporate culture and developing human resources capable of venturing beyond specialized fields to explore new areas of demand adjacent to our core businesses. This approach has enabled us to build a strong foundation of non-financial assets—particularly organizational adaptability and resilience—that provide a competitive advantage in responding effectively to changing circumstances.

Q3. Outlook for the Cosmetics Business, Which Has Achieved Strong Growth to Date

Our cosmetics business has achieved significant success through the creation of groundbreaking products inspired by pharmaceutical concepts, combined with the expansion of a new sales channel—the drugstore. Today, drugstores have become the primary retail channel for cosmetics sales, where we have secured the No.1 position in terms of sales volume. This success can be attributed to factors such as high customer satisfaction and strong evaluations of cost performance, as well as word-of-mouth recommendations and social media advocacy. Unlike conventional cosmetics brands that emphasize glamorous brand imagery as their core value, our strength lies in the trust and positive experiences of real users. Going forward, the key to sustained growth will be the continued development of science-based, high-quality products that incorporate cutting-edge ingredients and formulation technologies.

In recent years, aesthetic dermatology has become more accessible, and consumers increasingly expect professional-grade results. As such, ingredient development based on medical research and expertise derived from regenerative medicine are becoming essential to innovation in this field. While this area remains in an early stage of development, the overall cosmetics market remains vast, and we believe there are ample opportunities for further business expansion.

Q4. How Is the Competitive Landscape in the Cosmetics Business Expected to Evolve?

Competition with existing major players remains intense, with market share battles taking place on a daily basis. In recent years, however, the industry structure has been undergoing significant transformation. The rapid growth of fabless emerging brands driven primarily by marketing, the increasing popularity of private brands developed by large-scale drugstore chains, and the rise of ODM manufacturers supporting these trends are reshaping the competitive landscape. We anticipate that these developments will present major challenges going forward.

In addition, cosmetics from Korea and other parts of Asia are gaining popularity, particularly among younger consumers such as Generation Z, further intensifying competition. To address these changes, our core strategy lies in strengthening our scientific expertise, which is one of our fundamental strengths. At the same time, we aim to capture emerging marketing trends quickly through our Asian subsidiaries and continue to launch new brands targeted at younger generations.

Notably, “Hadalabo” and “Melano CC” were both launched as new brands and have grown rapidly in the market. We consider the ability to establish and scale up new brands swiftly to be one of our key competitive advantages.

Q5. Will Rohto Continue to Invest in Their Own Manufacturing Facilities?

We believe that in order to create truly differentiated products, it is essential to develop manufacturing technologies within our own facilities. At the same time, we will continue to maintain strong partnerships with leading ODM manufacturers, particularly in areas where they possess technological strengths or speed that complement our own capabilities.

Our production technology divisions, which underpin our manufacturing excellence, will play an increasingly important role as we expand globally. We are advancing the development of digitally integrated smart factories (CPS: Cyber-Physical Systems) and plan to establish next-generation facilities both in Japan and overseas, incorporating technologies such as AI and humanoid robotics. In Japan, the manufacturing sector faces a nationwide shortage of workers. While we are promoting automation and unmanned operations, securing and developing employees who can operate and manage these advanced systems is also a key priority. For this reason, our factories are not treated as separate organizations but as integral divisions of our core operations, with initiatives to professionalize and enhance the expertise of regular employees.

From a global perspective, we have pursued a local production for local consumption strategy by establishing manufacturing and supply chain networks as close to local markets as possible. In light of the recent rise in trade barriers between regions, we believe this approach has proven to be both timely and effective. Looking ahead, we plan to continue making proactive investments in manufacturing facilities, particularly to meet growing demand in emerging markets.

Q6. What Is the Future Outlook for the Department Store Cosmetics Business?

Although department stores—once a dominant retail format across Japan’s major cities—have faced challenging conditions, we have concentrated our presence in top-tier department stores in major metropolitan areas such as Tokyo and Osaka. These stores continue to perform well and attract strong inbound demand from overseas visitors. Our “Episteme” brand has now been firmly established over the past 15 years, holding a solid presence among leading domestic and global luxury brands. In particular, the “Stem Science series”, which incorporates regenerative medicine technology, has gained strong popularity. This premium category has strengthened our brand credibility through features in magazines and endorsements from beauty experts and influencers. The resulting online exposure has further enhanced our corporate value in the eyes of consumers.

Our skin consultants, who serve customers at department store counters, are employed as regular staff, and their skills in personalized consultation have contributed not only to the in-store experience but also to customer service excellence in drugstores, e-commerce, and call centers. Going forward, our department store brands—which represent the pinnacle of our technological expertise—will serve as flagship brands to be expanded globally alongside other leading luxury brands.

Q7. Can We Continue to Succeed in the Highly Competitive Hair Care Market?

The hair care market is fiercely competitive, with numerous powerful players, but we aim to provide unique values through science-based product innovation. Our medicated shampoos for scalp conditions such as dermatitis and dandruff have been steady-selling products in Japan for nearly two decades. Overseas, our “Selsun” and “50 Megumi” brands enjoy strong popularity, particularly across Asia. In addition, our “DEOU” and “DEOCO” brands, focused on odor care, have established loyal user bases.

“GYUTTO”, launched last year, became a hit by applying university-led research into hair structure to deliver benefits from a completely new perspective. Our minoxidil formulations are steadily growing in the e-commerce channel, and we see significant business opportunities—both domestically and internationally—in developing hair-growth products that activate follicle stem cells and color treatments that offer both high efficacy and scalp gentleness. We believe that hair care, even more than skin care, presents vast potential for future expansion.

Q8. What Is the Outlook for the Eye Care Business?

The domestic OTC eye drops market has continued to grow moderately, even as the overall OTC sector has stagnated. However, we expect future growth to come primarily from higher-value, multifunctional products rather than increased volume. Overseas, the use of eye drops is not yet as widespread as in Japan, suggesting significant growth potential. As we have been steadily developing and registering products tailored to each country’s regulatory environment, we anticipate steady expansion in the global market. In the medical field, we are developing innovative products not currently available in the market, with the first launches expected within the next two to three years—creating entirely new business opportunities. Additionally, “myopia prevention” is drawing attention as an emerging healthcare need, with new pharmaceuticals and supplements expected to appear in this category. We are actively pursuing development in this area, viewing it as a promising long-term growth domain. Beyond pharmaceuticals, we are also engaged in the development of surgical instruments, digital devices, and cell-based therapies, aiming to establish ourselves as a comprehensive provider of eye care solutions.

Q9. What Is the Future Outlook for the Oral Medicine Business?

Our gastrointestinal medicines, such as “Shiron” and “Pansiron”, have been cornerstone products since our founding and have long supported our growth as top-selling brands in the Japanese market. Although intensified competition has placed these brands within the third-tier group in recent years, “Panshiron Cure”—targeting acid reflux—has been well received, showing signs of brand revitalization.

Our “Wakansen”, herbal medicine series, has been struggling, and we plan to maintain its current level for the time being. In contrast, our “Rohto V5” eye care supplement series has performed strongly, generating over 5 billion yen in annual sales—mainly through our own e-commerce channels supported by a solid base of loyal subscribers. While our own e-commerce business started later than competitors, our focus on high-functionality products rather than low-value, generic supplements has proven successful. We will continue to broaden our product lineup around these loyal users to drive further growth.

Q10. What Is the Strategy Behind the Acquisition of Eu Yan Sang International (EYS), and What Returns Are Expected?

Our strategy is to leverage EYS’s numerous strengths—including its 146-year-old brand heritage, its expertise in high-quality traditional Chinese medicine, herbs, and food products, its base of 650,000 active customers in Hong Kong, Singapore, and Malaysia, and its integrated retail and clinic network—to establish a leading position in the shift from chemical-based vitamin and mineral care to Natural Health & Wellness.

Although current results are below initial expectations, this is mainly due to economic slowdowns in Hong Kong and Singapore—EYS’s core markets—and the lower-than-expected demands of the high-end gift segment. In response, we are pursuing cost reductions through higher in-house production and developing new, more affordable product lines to attract new customers, supported by strengthened marketing leveraging the expertise of the Mentholatum Company.

Through this acquisition, our Asian sales have surpassed 100 billion yen. By combining the strengths of the “Mentholatum” brand in skin care with EYS’s capabilities in oral and food-based wellness, we aim to become a unique, integrated self-care provider across Asia.

Q11. What About Other OTC Fields? Will We Enter New Market Segments Where We Are Not Yet Present?

Our “Mentholatum” brand of topical treatments continues to perform strongly, with “EXIV”—our athlete’s foot medication—now established as a market leader despite being a later entrant. Our “DoTest” line of pregnancy and ovulation test kits, which we were the first to introduce as OTC products in Japan, also maintains its position as a top brand. Should new testing categories become available for OTC sale, we expect to leverage the “DoTest” brand for effective market entry.

Conversely, we have not entered larger OTC segments such as energy drinks, vitamins, cold remedies, pain relievers, or patches. Given the limited growth prospects and high brand dominance of existing players in these markets, as well as the challenges of clear product differentiation, we currently see little strategic merit in entering these categories.

Q12. What Are Our Expectations for Switch OTC Products?

In Japan, there is ongoing discussion regarding the reclassification of prescription medicines to over-the-counter (switch OTC) status, and we expect gradual progress in this area. However, the impact on our business will likely be limited to certain categories such as eye drops, dermatological products, and diagnostic kits. While we expect some contribution from these areas, we do not regard switch OTCs as a major strategic pillar for the company as a whole. Instead, we will continue to focus on developing proprietary technologies and innovative products that can generate demand independently of the switch process.

Q13. What Is the Outlook for Our Prescription Pharmaceuticals–Related Businesses?

Regarding the ophthalmic pharmaceutical operations of our subsidiary Rohto Nitten, despite the challenging environment of ongoing NHI drug price reductions, we continue to generate profits through corporate efforts such as fully utilizing our production facilities by manufacturing and selling our own products while also undertaking OEM production for other companies.

In contact lenses, although we are a later entrant with lower brand recognition, sales are gradually increasing as we continue to introduce competitive products from overseas partners. In recent years, we have also strengthened our position as a specialized manufacturer by expanding our lineup of products used in ophthalmic procedures—such as lacrimal duct tubes acquired from other companies—thus pursuing growth opportunities even at a smaller scale. Looking ahead, we expect the prescription ophthalmic market to expand overseas, and we plan to leverage Rohto Nitten’s technologies and know-how to capture this growth.

Q14. We Intend to Strengthen R&D—In Which Fields Do We Compete, and What Are Our Advantages?

In our existing domains of eye care and skin care (including hair care), our basic research and product development teams have worked closely to commercialize products swiftly. Going forward, we will further advance fundamental, cell-level research. To that end, building robust collaborations with academia is essential. In eye care, we have supported young researchers for 25 years through the Rohto Award, and many awardees now serve as leading figures in Japan’s ophthalmic research. Through this initiative, we have built connections with top experts across multiple fields, forming a strong foundation for future R&D. Similarly, our networks cultivated via the Geriatric Dermatology Research Fund and the Japanese Dermatological Association’s Dermatological Research Fund have grown, and we are recognized as a distinctive presence among pharmaceutical companies.

On the intellectual property front, in the “Pharmaceutical Industry Patent Asset Scale Ranking 2024,” we ranked sixth, alongside 1) ROCHE, 2) MERCK, and 3) PFIZER, demonstrating strong deterrent power to other pharmaceutical companies. In this way, our R&D capabilities—though not fully visible on financial statements—constitute a highly powerful competitive resource.

Q15. What Is the Outlook for New Ophthalmic Drug Development? What Are the Expected Scale and Profitability?

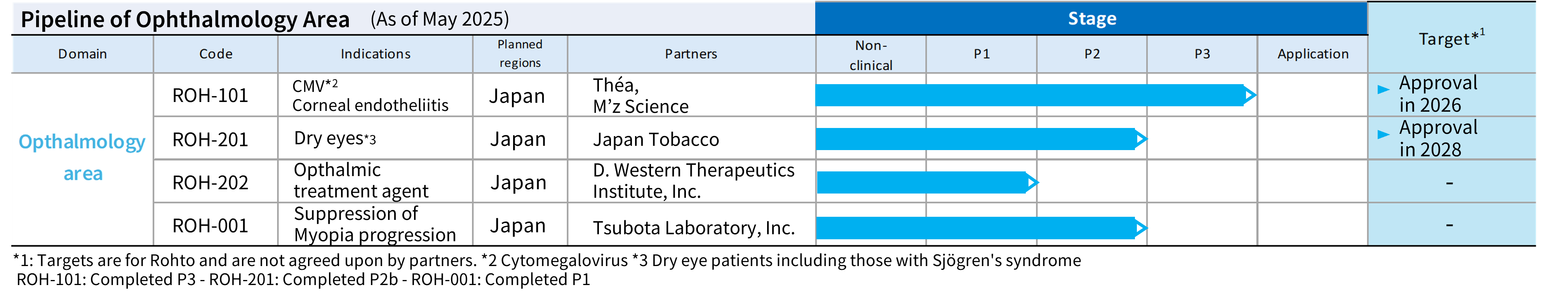

Our development pipelines are generally progressing as planned, with some candidates approaching the stage of regulatory submission. While, for strategic reasons, we do not disclose details on additional assets or the projected scale of each business, we are targeting clear unmet medical needs and areas with substantial global market potential, and we therefore expect to secure sufficient profitability over the long term.

New drug development inherently carries the risk that anticipated efficacy and safety may not be confirmed in clinical trials. However, many ophthalmic eye drops candidates are developed after mechanisms of action have already been validated in oral or other systemic therapies, and relevant data on efficacy and safety are relatively well accumulated—reducing development risk compared with other modalities. With respect to the significant clinical trial costs, we will continue to evaluate overall profitability with rigor and make strategic go/no-go decisions accordingly.

Q16. What Business Opportunities Does Rohto Foresee in Medical Fields Beyond Ophthalmology?

We see opportunities in dermatology and musculoskeletal/orthopedics. In dermatology, our DRX series—clinic-exclusive cosmetics—has built a strong track record over more than 20 years. With aggressive market expansion by Korean players, we expect the category to grow further. Rather than pursuing reimbursed prescription drugs, we aim to expand professional skin care (including hair care) used under dermatologists’ supervision to drive growth in the dermatology field.

We have also successfully developed the “Autologel” PRP therapy system for refractory ulcers and launched it in January 2025, marking a significant step toward improving patient quality of life. We will expand its adoption to benefit more patients.

In musculoskeletal/orthopedics, we are advancing products for knee cartilage repair using cultured chondrocytes, materials for meniscus repair, and investments in ventures related to these areas. We believe maintaining healthy, active mobility is central to well-being, especially in a longevity society.

Q17. What Are the Approval Timeline and Business Scale Expectations for Cell-Based Products?

We are progressing multiple cell-therapy pipelines and anticipate approvals from 2030 onward. Given regulatory and pricing uncertainties in this field, we are planning conservatively for business scale. Among the targets, knee joint cell therapy is already moving toward practical adoption, and we expect steady market formation in a super-aged society. Interstem Co., Ltd., our subsidiary, is advancing a chondrocyte product designed to offer advantages over existing technologies. Post-approval commercialization may not be conducted solely by us; we will also consider out-licensing and explore international co-development/licensing opportunities.

Q18. How Much Has Rohto Invested in Regenerative Medicine, and What Are the Mid- to Long-Term Return Expectations?

Over the past 15 years, our total investments related to regenerative medicine—equity stakes and acquisitions—amount to approximately ¥10 billion. Looking ahead to 2030, within a total M&A budget of ¥50 billion, we will pursue opportunities as appropriate. On development costs, the largest component is clinical trial expenditure. To date, cumulative spend is around ¥2 billion, and going forward we expect ¥1–2 billion per year on average, subject to annual variation. Continuation decisions at each clinical stage will be made strategically, based on the then-prevailing market outlook.

Q19. In an Era of Intensifying Global Competition in Cell Therapies, How Will Rohto Compete?

Many global players from adjacent industries are entering cell therapy with growing investment scales. We remain distinctive in covering the continuum from basic research to manufacturing and clinical application. While the overall field is expected to become a sizable industry, we do not foresee dominance by a few players; rather, a diverse ecosystem of specialists will emerge. We aim to act as a connector and leader, integrating capabilities across domains to develop new treatments.

Q20. What Is the Outlook for the Contract Manufacturing/Processing of Cells? How Will Rohto Compete Against Large New Entrants?

Leveraging know-how cultivated through our own development, we differentiate by closely addressing client needs. Our strengths include cell culture technologies, media development/customization tailored to cell type and indication, and end-to-end support from development through regulatory submission. Beyond cell-therapy manufacturing, we are also moving early into new modalities such as extracellular vesicles (EVs, including exosomes). These initiatives position us to sustain growth and demonstrate unique strengths even as large cross-industry players enter the market.

Q21. Is It Too Risky for Rohto to continue Regenerative Medicine Business? Should Rohto Focus on Conventional Business Like Skin Care?

Regenerative medicine is relatively immature and regulatory frameworks are still evolving, so volatility risks are real. However, compared with new chemical entity development, cell-based approaches—leveraging intrinsic human cell functions—can offer favorable safety and multi-faceted mechanisms, with potential to address diseases previously beyond reach.

Our strength lies in the cross-fertilization of cell and regenerative research with product development in eye care, skin care, and oral categories—making these technologies both essential and broadly applicable. As competition (especially global) shifts toward cell-level science, owning frontline knowledge and IP becomes a decisive advantage. Our cell-science foundation also underpins basic research for skin care and beyond—an advantage versus ventures focused solely on pharmaceuticals.

Q22. What Are Rohto’s Strategy and Priorities for Global Expansion?

We position Southeast Asia as our global growth driver, sustaining high growth in core eye care and skin care while actively developing hair care, food/supplements, and medical businesses. With Vietnam and Indonesia as hubs housing our own plants and R&D, we see substantial upside in Malaysia and the Philippines. In China, we will maintain a solid Health & Beauty base while strengthening hair care and medical initiatives and developing China-specific value propositions by integrating rapidly advancing local technologies—capturing structurally growing healthcare demand. Globally, we will build “Rohto eye drops” and “Hadalabo” as worldwide brands. In eye care, we will expand into Europe centered on Mono (Austria), acquired last year. For skin care, “Hadalabo Tokyo”—launched from Poland—has achieved hits in previously hard-to-enter markets such as the UK and Australia, and will expand further worldwide. We will also continue to explore M&A opportunities to broaden the quality and geographic reach of our Healthcare/Well-being portfolio.

Q23. How Does Rohto Mitigate Risks When Operating Across Many Countries?

Operating globally entails geopolitical, governance, supply, reputational, and safety risks. We have established systems to manage these prudently. For geopolitical risk, we divide overseas subsidiaries into five regions and establish region-centric manufacturing and resources, enabling procurement and autonomous operations even if logistics are disrupted. For governance, five regional headquarters enforce management aligned with our Group philosophy, and we deploy a global head-office hotline across subsidiaries. In finance, we use flat consolidation under Japan headquarters to directly manage regional subsidiaries—strengthening global governance through multiple layers.

Q24. What Qualities Does Rohto Require for Future Leaders?

Next-generation leaders must combine deep scientific literacy with sound managerial judgment—including the ability to prioritize R&D investments and evaluate returns based on scientific insight. Managing a diverse portfolio—skin care, eye care, prescription/regenerative medicine, and overseas operations—requires risk-aware strategy and strong governance. In a VUCA era, we value decisive, change-oriented leadership and the ability to foster psychological safety. We seek leaders who pair strategic and scientific acumen with humanity and trustworthiness, consistent with our founding value of “respecting people.” Recognizing that concentrating all qualities in one person is increasingly difficult, we promote a team-based leadership model, with internal development and external recruitment driven by the Nominating Committee.

Q25. Rohto Has a Company with Board of Auditors. Why Not Adopt the Company with Audit and Supervisory Committee Structure?

The key difference is that an Audit and Supervisory Committee acts only by collective resolution and individual members lack authority to conduct investigations independently. By contrast, Statutory Auditors operate on an individual basis and can act swiftly—an advantage in emergencies and for governance reinforcement. We therefore prefer the Board of Auditors model and have strengthened it by appointing three outside statutory auditors to ensure full functionality.

26. The Nominating and Compensation Committees Are Voluntary Advisory Bodies—Do They Function Effectively?

Both committees serve as advisory bodies to the Board and are composed with a majority of outside directors to ensure objectivity and fairness. Members with deep understanding of our business conduct multi-faceted discussions reflecting internal and external realities. We believe the committees are fulfilling their intended roles.

Q27. Why Not Make Outside Directors a Majority on the Board?

We currently appoint five outside directors. For final decision-making, it is critical that our Board include a diverse set of directors with deep business knowledge and leadership across domains—vital for business continuity and leadership development. While outside directors are not a majority, we ensure transparency through outside-director-led Nominating and Compensation Committees and third-party evaluations. We will continue to optimize Board composition according to external conditions and corporate stage, maintaining our balanced Board—an integration of internal and external expertise—as a competitive advantage. Our Board of Auditors has a majority of independent outside auditors to further strengthen governance.

Q28. The President and Chairman Do Not Use CxO Titles. How Are Roles and Responsibilities Defined?

Both roles are pivotal and closely coordinated to drive sustainable growth and value creation. Rather than a strict CEO/COO hierarchy, we operate on equal footing, leveraging respective strengths. The Chairman takes a long-term, group-wide view—crafting vision and building external networks. The President leads line organizations, executing mid-term strategy and overseeing day-to-day operations. We maintain flexibility in role allocation to respond quickly to change; this complementary model best supports our management goals.

Q29. What Is Rohto’s Basic Policy and Stance on Shareholder Engagement?

Our policy prioritizes equality and fairness, with transparent disclosure. For retail investors, we provide information via IR seminars and online briefings. For institutions, the Vice President & CFO and IR team lead meetings and sessions on strategy and finance. Feedback is shared with management and the Board to inform value-enhancing decisions. Where information is competitively sensitive or potentially misleading in a long-term context, we may refrain from disclosure after careful judgment. We adhere to fair disclosure, making proactive, principled decisions aligned with diverse investor needs.

Information Disclosure Policy

Q30. How Are Directors’ Compensation Determined, and Why Does Rohto Not Use Performance-Linked Stock Options?

Compensation comprises base and performance-based elements. Base pay reflects role and responsibility; performance pay includes annual performance and mid-/long-term value-creation components, with the latter emphasized to align with our long-term management focus. Because mechanisms heavily influenced by short-term earnings or share price do not fit our philosophy, we do not adopt stock options commonly used elsewhere. Our program is designed to incentivize correct long-term decision-making.

Q31. How Does Rohto Think About the Cash Position on the Balance Sheet?

Our financial policy aims to simultaneously achieve sound balance, growth investment, and enhanced shareholder returns—delivering resilient profitability amid uncertainty and sustainably increasing corporate value. We maintain a robust equity ratio, secure sufficient operating cash and growth-investment capacity, manage capital costs, and strive to keep ROE/ROA at healthy levels through balanced, efficient treasury management.

Q32. What Is the Rationale for the Convertible Bonds Issued in February 2025, and What Are the Policies for Future Financing and Share Buybacks?

To fund the EYS acquisition, we used cash at Asian subsidiaries and bank borrowings, which increased interest-bearing debt and lowered the equity ratio from the 70% range to the 60% range. Issuing zero-coupon convertible bonds enabled us to repay bridge loans and diversify funding for share repurchases and future R&D/growth investments, maintaining a healthy financial balance. Even after issuance costs, funding was effectively at negative interest rates over the long term in a rising-rate environment.

We estimate ¥20 billion of additional financing over the next six years, choosing optimal methods consistent with our policy. Given current conditions, no near-term buybacks are planned; future decisions will weigh our financial balance, investment pipeline, and market valuation.

Q33. What Is the Basic Stance on M&A?

Our M&A objective is to enhance customer value by partnering in new businesses, channels, or regions where we lack presence. With a solid cash position, we evaluate targets for mid-/long-term profitability and limited margin dilution. Rather than large deals like EYS, we target cumulatively ¥50 billion by 2030, selecting opportunities that fit our growth strategy and support sustainable value creation.

Q34. What Is the Rationale for Rohto’s CSV Activities? Do They Generate Returns?

Guided by our philosophy—serving society as a public entity—we place social contribution through our core business at the center of corporate activity. CSV aligns naturally with our operations, simultaneously addressing social issues and business growth. Beyond self-care and professional care, we partner with local governments, NPOs, and regional companies to tackle issues we cannot reach alone. These efforts strengthen community trust, employee engagement, and brand equity, supporting sustainable growth. While short-term, direct profit attribution is difficult, improved reputation and recognition translate into consumer support and corporate trust for our products.

Q35. Rohto Is Expanding into Food—What Is the Probability of Success?

Our food initiatives leverage our scientific capabilities to promote healthy living. We see strong potential in supplements that can be marketed with quasi-pharmaceutical positioning, as evidenced by the success of “Rohto V5”. Diet is foundational to health and preventive care, making food integral to our social healthcare strategy. The EYS acquisition adds proven food-related business models, increasing the likelihood of success as we scale.

Q36. How Does the Performance Compare with Peers, and Is It Sustainable?

We occupy a unique position as an integrated healthcare company spanning cosmetics and OTC medicines, prescription and regenerative medicine, diagnostics, and food. While some majors compete in global brands and luxury channels, we advance science-driven differentiation—notably in skin and eye care—through product development and formulation technology.

With operations in over 115 countries, we tailor brands to local needs and utilize local production, building resilience to FX and regulatory shifts. Historical results demonstrate stable, sustained growth versus peers, validating our strategy, and we have achieved 21 consecutive years of dividend increases. We aim to continue steadily enhancing shareholder value.

Q37. What Is the ESG Stance?

In line with our Articles-based philosophy and Seven Declarations (values code), we work with all stakeholders—consumers, partners, employees, investors, and communities—to realize a well-being society and enhance corporate value. We have identified five materialities: Well-being through business, maximizing human capital, contributing to a sustainable environment, coexistence with society, and strengthening the management foundation. ESG is central to strategy, and we also emphasize “Health (H)” as a core value, promoting ESH management, which directly links to management incentives.

Q38. What Is Rohto’s View on DEI?

To continuously create value amid diversification and globalization, diverse talent must share values, challenge one another, and grow together. We cultivate an inclusive culture with high psychological safety, advancing diversity initiatives. Examples include long-standing support for women’s advancement (now 30%+ women managers), policies for LGBTQ+ inclusion (e.g., same-sex partner registry, SOGI conduct guidelines), increased hiring and inclusion of global talent, and inclusive disability employment practices.

Q39. What Is the ROE Target? It Is Lower Than Some Global Peers—Will You Try to Raise It?

ROE is a key measure of shareholder value creation. For FY2024, our ROE was 12.1%, sustaining double digits while in an investment phase—evidence of healthy efficiency relative to peers. Forcing ROE up to global-mega levels is neither sustainable nor effective given scale differences. Our policy is to maintain double-digit ROE and raise corporate value through steady, continuous growth.

Q40. What Is Rohto’s View on the Share Price?

Share prices fluctuate with market conditions and investor behavior; by law and prudence, we do not act to directly influence daily price movements. Our focus is sustained, long-term value creation, which guides all decisions. Over the past 20 years, corporate value has steadily increased and has tracked with the share price over the long term. We commit to consistent, decisive management rooted in this philosophy for all stakeholders.

The information presented on this page is as of September 2025.

For details regarding our disclaimer, please refer to the disclaimer here.