The ROHTO Group recognizes that the prevention of global warming and harmony with the natural environment are important management issues for achieving both business growth and the realization of a sustainable society.

In June 2021, informations expressed our support for the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD).

In the future, based on the recommendations of TCFD, we will promote information disclosure to stakeholders from the four perspectives of governance, strategy, risk management, and indicators and targets regarding the "risks" and "opportunities" posed by climate change on our business, and we will actively work to respond to climate change on a Group-wide basis.

Governance

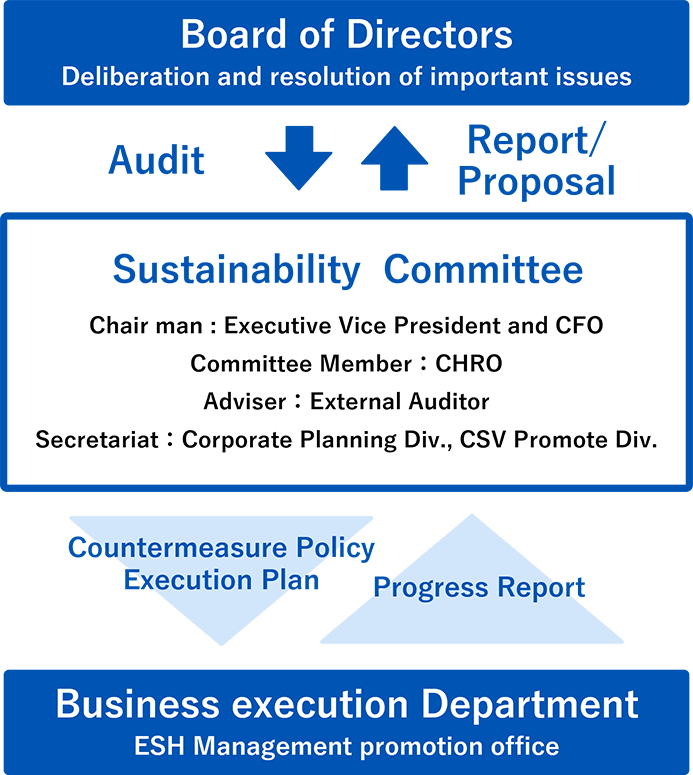

The Company established a Sustainability Committee to discuss risks and opportunities related to climate change, determine policies for addressing them, and roll out these policies to the Group. The Board of Directors receives reports on the content of these deliberations and discussions, and deliberates on the Group’s response to climate change, including disclosure to and dialogue with stakeholders and capital expenditure plans from a long-term perspective, and supervises the implementation of these plans.

The Sustainability Committee consists of two Directors and one Outside Audit & Supervisory Board member who serves as an advisor, and is chaired by the Executive Vice President. The Executive Vice President concurrently holds the position of Chief Financial Officer (CFO) of the Group, and is responsible for evaluating and managing environmental issues as financial issues.

Strategy

We evaluated the impact of risks and opportunities related to climate change

on our business, focusing primarily on the financial impact. We have local

development and production bases in major countries with business footprint

and have built a system that is resilient to the fragmentation of the value

chain caused by climate change. In scenario analysis, referring to several

scenarios, etc. announced by the Intergovernmental Panel on Climate Change

(IPCC), we examined the comprehensive impact of each of the 1.5℃, 2℃ and

4℃ scenarios on our major global operation bases: Japan, China, Vietnam,

and the U.S. Based on the classification defined by the TCFD (transition

risks, physical risks, and opportunities), we examined the potential impact

of climate change on our business and measures being taken. Going forward,

we will continue to analyze and evaluate various scenarios on an ongoing

basis and deliberate on countermeasures, thereby enhancing our resilience

to an uncertain future.

Future Scenarios

1.5℃/2℃

Scenario |

The global growing calls for decarbonizing will lead to introducing a carbon

tax and enhancing regulations on fossil fuel-derived materials, such as

plastics. Corporate activities will further shift their focus to more environment-consciousness,

such as procurement and use of raw materials, containers, and packages

produced through the decarbonized process and renewable energy. |

| Changes in consumers' and retailers' sentiments will seek the transactions

and distributions of products manufactured through the low-carbon process

and sustainability-conscious procurement. Technological innovation for

those purposes will also advance. |

4℃

Scenario |

Escalation of natural disasters, such as typhoons, due to climatic extremes

will raise the risk for unpredictable storm and flood damage. |

| Changes in the environment and ecosystem due to the escalation of natural

disasters and increase in temperature will raise the risk for a decline

in resource production and yield amount, resulting in high risks for depletion

of raw materials and the outbreak or spread of infectious diseases. |

| Increase in ultraviolet radiation and temperature changes will worsen people's

quality of life (QOL), and people will strongly need healthcare goods that

can improve their daily life quality. |

*If the right edge of the table is cut off, scroll horizontally to check.

Transition Risks and Opportunities in Decarbonized Society and Responses

to Risks and Opportunities

| Risk Items |

Impact on Business |

Degree of Impact |

Response to Risks and Opportunities |

| Main Category |

Sub-category |

1.5℃/2℃ |

4℃ |

| Policies/Regulations |

Introduction of carbon tax |

Factory operation and transportation costs will rise due to the introduction of a carbon tax in overseas countries. (Risk) |

Moderate |

- |

・Emissions reduction measures under implementation toward the reduction targets set for Scope 1 and 2. |

| Introduction of limitations and regulations on CO2 emissions (such as restrictions on the use of plastics and petroleum-derived raw materials and imposing a use tax) |

Procurement costs will rise due to regulations mandating or using renewable raw materials and other restrictions. (Risk) |

Moderate |

- |

・Reduce plastic usage and increase the usage rate of recycled materials.

・Simplify and reduce the weight of containers and packaging materials.

・Switch to containers and packages that use renewable raw materials. |

| Mandatory use and increase in use amount of renewable energy |

Energy procurement costs will rise with an increase in the electricity utility rate due to the switch to renewable energy. (Risk) |

Moderate |

Moderate |

・Advance the reduction of energy usage by setting the reduction targets.

・Advance the switch to renewable energy and promote investment in environment-conscious facilities. |

| Market |

Increase in raw materials costs |

Raw materials procurement costs will rise due to the worldwide scarcity of the supply of environment-conscious raw materials and the shifting of price hike of raw materials with the introduction of a carbon tax. (Risk) |

Moderate |

High |

・Consider dispersed and diverse procurement and alternative raw materials and assess their impact on the product quality. |

*If the right edge of the table is cut off, scroll horizontally to check.

Physical Risks, Opportunities, and Responses

| Risk Item |

Impact on Business |

Degree of impact |

Response to Risks and Opportunities |

| Main Category |

Sub-category |

1.5℃/2℃ |

4℃ |

| Chronic Risks |

Rise of average temperature |

Procurement costs will rise due to the supply deficiency of natural raw materials or similar situations. |

Moderate |

Moderate |

・Consider dispersed and diverse procurement and alternative raw materials and assess their impact on the product quality. |

Demand for UV protection-related products, such as sunscreen and anti-blemish goods, will expand. (Risk)

Sales will expand due to prolonging the peak demand period for UV protection through a year. (Opportunity) |

Moderate |

High |

・Enhance development of sun-care technology.

・Consider development of UV protection products, including cosmetics and oral medicine. |

| Rise of sea level |

Factories, facilities, and offices, including those of our suppliers, located in low-level areas will suffer tremendous impact, such as the shutdown of operation, due to water exposure. (Risk) |

Low |

Low |

・Currently, it is assumed that the Group's offices and facilities are not potentially affected.

・Grasp our suppliers' situation. |

| Scarcity of water supply for use |

In the production area where groundwater is used, water depletion will make water use difficult, and restrictions on water intake/discharge or hikes in procurement costs will lead to production limitations or cost increases. (Risk) |

Moderate |

Moderate |

・Check the water usage quantitatively.

・Promote the efficient use of water resources. |

| Acute Risks |

Suspension of production/manufacturing functions and breakdown of logistics function due to natural disaster |

The suspension of procurement and supply due to the severed supply chain will cause the loss of sales opportunities, resulting in a decline in revenue. (Risk) |

High |

High |

・Review BCP, advance dispersed and diverse procurement, and optimize the inventory level.

・Closely coordinate with our suppliers and distributors. |

| Market |

Changes in consumers' demand and behavior |

Sales of environment-conscious products will expand with the rising demand, and the company's pro-environmental activities will receive high evaluation from the market. (Opportunity) |

Moderate |

Moderate |

・Develop environment and ecosystem-friendly products.

・Set evaluation indicators for environmental impacts in coordination with outside test & evaluation agency(ies). |

*If the right edge of the table is cut off, scroll horizontally to check.

Risk management

(1) Identification and evaluation process for climate-related risks

In accordance with the framework proposed by the TCFD and the prediction of changes in the external environment, the Sustainability Committee identifies the degree of impact which climate change risks poses to our business, based on our resources and the services we provide.

(2) Process for managing climate-related risks

The Sustainability Committee manages the identified risks and holds discussions on their responses. The Committee convenes the heads of related sections as necessary to confirm more specific measures and promote them in a flexible manner.

(3) A system to integrate the above process into the Company’s comprehensive risk management

The Sustainability Committee also evaluates and manages risks other than environmental issues that may affect the sustainability of our business in a comprehensive manner. Depending on the case, the Sustainability Committee will also discuss with the Compliance Committee, which is chaired by the President and Chief Operating Officer, to formulate a BCP.

Metrics and targets

We have set our CO2 emission reduction target for Scope 1 and 2 for 2030 at a 46% reduction

compared to fiscal 2013 levels, and are taking actions to achieve this

goal. CO2 emissions in fiscal 2023 were 12,722 tons for Scope 1 and 2 combined

(reduction of 19.6% compared to fiscal 2013 levels). Additionally, starting

in fiscal 2023, we have begun calculating Scope 1 and 2 emissions not only

of the Company but also of Japanese subsidiaries with major production

bases. We will continue to aim for reductions throughout the Group.

Carbon Neutrality